Post From Community Close Ups

Utah is facing a looming housing crisis as the state continues to experience a shortage of affordable housing. In a place where demand is far outpacing supply, the state is mobilizing around efforts to not only build new housing stock but to maintain its current supply of affordable units before residents are priced out of their homes. One of the champions spearheading this strategy is Intermountain Healthcare, a not-for-profit integrated healthcare system (both health provider and payor) headquartered in Utah. Intermountain joined forces with a foundation, a CDC (Community Development Corporation), and a bank to create the Utah Housing Preservation Fund, which is tackling the crisis through investments in maintaining Utah’s affordable housing supply.

Intermountain Healthcare’s commitment to the communities of Utah dates back to its founding. In the 1970s, the Church of Jesus Christ of Latter-day Saints donated its hospital systems to the neighborhoods they served with the aim of becoming a model health system that functions as more than a healthcare provider but as a anchor-institution . True to its origins, Intermountain Healthcare has spent decades giving back to the Utah community through large-scale philanthropic efforts. Now, the healthcare system is building on this commitment, including investing more than $13 million into preserving affordable housing and support for locally owned businesses through their impact-investing work.

Learn more about Intermountain Healthcare’s Impact Investing. Photo credit/Intermountain Healthcare

This legacy shows up through Intermountain Healthcare’s pledge to address upstream factors like lack of affordable housing and economic development, or the social determinants of health that impact health inequities. As a non-profit hospital system, Intermountain Healthcare once siloed their SDOH work to their community health department and foundation. With the support of the Healthcare Anchor Network (HAN), a collaboration of healthcare systems dedicated to building more suitable and inclusive economies, Intermountain Healthcare pivoted and committed to applying their upstream focus more broadly across other functional areas of the organization. This included supply chain practices, hiring practices, and provided a template for how the hospital could leverage its treasury dollars to put more investment towards upstream interventions. Initial critical steps included hiring a director of Impact Investing, Nick Fritz, and elevating the community health officer, Mikelle Moore, to an executive team role. Moore is a strong advocate for this new direction as someone who understands the value of upstream investments. Moore formerly ran a large hospital for Intermountain Healthcare, where she would see the same patients in the emergency room for insulin because they didn’t have a home or refrigerator to store it. “It’s simple,” she said, “we can free up our emergency rooms, give someone better health, all for less money if we stop the problem from happening in the first place.”

Using the strength of [Intermountain Healthcare’s] balance sheet provided access to bigger dollar amounts than a typical grant, allowing the hospital system to put more money towards their SDOH efforts.

Intermountain Healthcare also decided to take money from their regular investments such as mutual funds and stocks and instead move it into their impact investing efforts. The community health department successfully garnered the buy-in from the finance team because their impact investing work involved the acquisition of financial assets, like real estate for affordable housing. Therefore, it uses the same controls and due diligence as other investments that help ensure a small financial return. At the same time, using the strength of their balance sheet provided access to bigger dollar amounts than a typical grant, allowing the hospital system to put more money towards their SDOH efforts.

The healthcare system further maximized these efforts by using another innovative approach, leveraging cross-sector partnerships to co-invest in preservation of affordable housing through the Utah Housing Preservation Fund.

Housing: 491 units constructed and preserved as affordable

Economic Stability: $3 million invested to support locally owned businesses

Public Health and Physical Conditions: 23 preservation units were updated for health and safety standards

Public Health and Medical Care: 100% of housing investments include services designed to help stabilize tenants. These include services such as free daycare and/or after school care for residents, credit bureau reporting of rent payments to boost credit scores, and connection to healthcare, education, housing, and other community resources.

Through investments via the Preservation Fund, Intermountain Healthcare can stop the bleed of affordable housing off the real estate market while also making health and safety upgrades.

Canyon Echo Apartments in Salt Lake City, which includes units purchased by the Preservation Fund. Photo credit/Utah Housing Preservation Fund

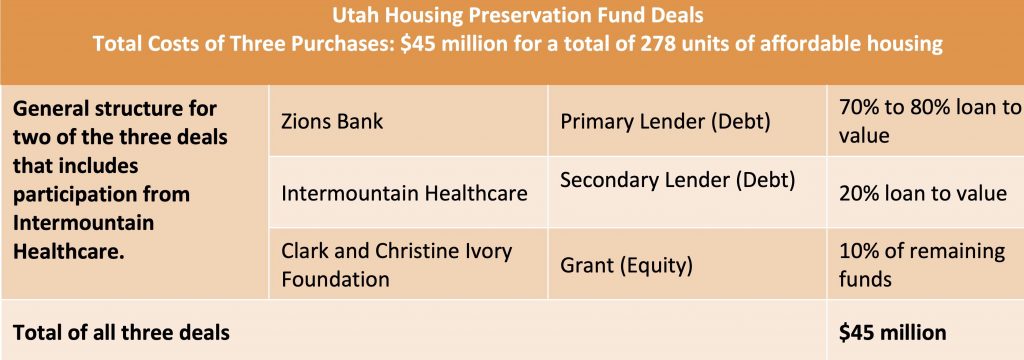

The Utah Housing Preservation Fund (the Preservation Fund), owned and operated in Salt Lake City, aims to preserve the state’s most affordable housing units. Formed in 2020, this effort is a partnership between Intermountain Healthcare, Clark and Christine Ivory Foundation, Utah Non-profit Housing Corporation, and Zions Bank. Thus far, the partners of the fund have purchased 278 units at a total cost of $45 million. Two of these transactions included Intermountain Healthcare that resulted in 62 units preserved as affordable. The goal of this collective effort is to raise $100 million or more to prevent rent increases that displace residents and ultimately preserve 500 to 800 affordable units for households earning below 50 percent of the area median income.

Key Stakeholders: Intermountain Healthcare, Clark and Christine Ivory Foundation, Zions Bank, and Utah Non-profit Housing Corporation

Financing: A total of $45 million dollars spent, which includes investments from Intermountain Healthcare (for two out of three transactions), Zions Bank, and Clark and Christine Ivory Foundation. * One purchase includes 2.5 million in state apportions

Project status and scale: Three purchases with a total of 278 units preserved as affordable, 46 of which are managed by the Utah Non-profit Housing Corporation.

The Preservation Fund addressed an important affordable housing strategy for Intermountain Healthcare. The health system realized that preserving housing as affordable is more efficient than building new units and allows the healthcare system to have a more direct tie to health. Many of the purchased units are old, in poor condition, and in need of upgrades. Through investments via the Preservation Fund, Intermountain Healthcare can stop the bleed of affordable housing off the real estate market while also making health and safety upgrades. These renovations and upgrades will ensure a healthy living situation for renters but not so much that it leads to higher rents, avoiding evictions, and providing housing stability for residents. Additionally, the Utah Nonprofit Housing Corporation will work with housing authorities, service providers, and other organizations to maintain healthy housing for tenants most at risk for experiencing homelessness.

Click to view PDF of the table

To date, each purchase has been an individual deal, as there is no structure yet for the fund. The two deals that involved Intermountain Healthcare generally followed a similar arrangement. Zions Bank provided around 70% to 80% loan to value as the primary lender, Intermountain Healthcare invested 20% loan to value as the secondary lender, and the Clark and Christine Ivory Foundation came up with around 10% of the remaining funds for the transaction. In the case of one of the purchases, it included a two-and-half million-dollar appropriation from the state of Utah that came through the Olene Walker Housing Loan Fund to provide the remaining capital needed for the deal.

Properties purchased by the Preservation Fund include duplexes as well as apartments. Photo credit/Utah Housing Preservation Fund

In 2020, Intermountain Healthcare contracted Build Healthy Places Network to support the strategy development of a fund structure and growth as well embed health and racial equity principles. The hope is that by having a separate legal structure to invest in, as opposed to individual deals, it will be easier for investors like Intermountain Healthcare. Since each purchase is a separate transaction that looks a little different each time, Intermountain Healthcare needs to originate a loan and underwrite each one, making it administratively cumbersome and inefficient. As a healthcare system, Intermountain Healthcare is not set-up to operate as a lender, making investments through partners that have both the infrastructure and expertise in lending a more preferable option. With a formal fund, Intermountain Healthcare can invest while the Preservation Fund will make decisions about property purchases and take on some of the administrative burdens to ensure each deal works.

The aim is by mid-2021, with the support of a newly hired fund manager and by drawing from the work of Build Healthy Places Network, the fund will have a formal structure and be housed by the Utah Nonprofit Housing Corporation.

“So, when we think about addressing SDOH, we can do it because we do it together with partners in the community.”

Over the last decade, the issue of lack of affordable housing and homelessness continues to be a chief concern for the state of Utah and Salt Lake County. In response, the Clark and Christine Ivory Foundation, the foundation arm of Ivory Homes, pulled the partners together to discuss the issue. Non-profit and small property owners were selling their properties for short term cash gain, resulting in less affordable housing available in the state. As a result of this meeting, the partners decided to form a collaboration around a shared housing preservation strategy through the Preservation Fund.

Mikelle Moore, Intermountain’s senior vice president and chief community health officer, speaks at a news conference about the Utah Housing Preservation Fund. Photo credit/Intermountain Healthcare

Throughout this collaborative process, Intermountain Healthcare has realized the benefits of a cross-sector partnership. Nick Fritz explained that the healthcare system does not want to compete with banks but rather understand how different institutions can bring their own contributions to efforts that share a common goal. In the case of working with a community bank, Intermountain Healthcare became a secondary lender, which helps de-risk each deal for Zions, as the bank is no longer the sole lender. For the healthcare system, it can lean on the bank’s infrastructure as an entity that is well equipped to make loans. Nick Fritz reflected, “we are here to support banks and they are here to support us. There are things they wouldn’t invest in but with our help, they will. That’s better for our community, and that’s better for housing stability. So, when we think about addressing SDOH, we can do it because we do it together with partners in the community.”

These partnerships have proven to be instrumental in expanding the Preservation Fund’s work. Last year, because of efforts by the fund and its influential members, it secured appropriations from the state to do more housing preservation. This included two and a half million dollars in 2020, and in 2021, the fund received an additional $25 million contribution that came from legislative dollars earmarked for housing and homelessness efforts in Utah. These state dollars require the fund to raise additional private capital, which provides an opportunity for Intermountain Healthcare to reinvest and attract other investment partners.

One challenge of these efforts is to make the economics work. The Preservation Fund must pay a competitive price because of the competition of buyers who are willing to pay at or above the market rate. Even after the purchase, additional money is required to bring the properties up to standard, all while charging submarket rents. Through the power of cross-sector partnerships, the fund can continue to secure diverse sources of funding, such as public dollars, philanthropy, and private capital that will enable it to keep acquiring housing stock and maintain it as affordable for residents of Utah.

The Utah Housing Preservation Fund has had a ripple effect throughout the state. Intermountain Healthcare continues to meet with Community Development Financial Institutions (CDFIs) and other organizations interested in replicating the Fund’s housing preservation strategy. This is part of Intermountain Healthcare’s larger vision and goals of its impact investing work. Nicholas Fritz explains, “Part of Intermountain Healthcare’s hope through all of our anchor work is that we want to be an example for not just other healthcare systems but other people in Utah, other anchor institutions, and even the state legislature.”